Kaelyn Tallman, Ashley Patterson, Steven Felice, and Naharanpitage Ravidu Sheh Perera

What Defines a Small Business?

A small business comprises many entrepreneurial elements such as creativity, sales, and marketing. In addition to these elements, the economy can play an impactful role in the survival of small businesses. Economic factors such as recessions and labor economics, can make it difficult for small business owners to determine what action is best for the business. Because small businesses tend to deal with smaller markets in both labor and consumption, the decisions the owners make bear more weight, as poor decisions in marketing and operations could cost the business their share of the market.

According to the U.S. Small Business Administration (SBA), a small business is defined by its annual revenue and number of employees, with these thresholds varying depending on the specific industry. The SBA outlines size standards for numerous industries, ensuring a nuanced approach to defining “small” across the economic landscape. For instance, a small business in the manufacturing sector might have a maximum of 500 employees, while a small business in wholesale trade could have a maximum of 100 employees (Hait, 2021). This industry-specific approach acknowledges the varying scales within different economic sectors.

Small businesses as a whole face a pretty rough failure rate, where only a 25% share of established small businesses survive over 15 years (Bender et al., 2022). Many factors contribute to this small percentage. For this chapter the definition of small business should be applied to businesses which have only a self reliance. Meaning there is no bigger chain or business to bail them out of unexpected costs produced by the economy or disasters. This chapter will discuss how small businesses survive in regular times, and an analysis of survival post COVID-19 pandemic.

Why are Small Businesses Important and What Challenges did the Pandemic Cause?

Small businesses are incredibly important; they allow people to develop new ideas and have a sense of ownership in their communities. For example, if a person has an idea they are able to invest in that idea and create a product to sell whether it is online or at a storefront. These entrepreneurs tend to have found a new way to make things more efficient with their product, or their product might simply bring people joy. Small businesses help people feel that they have ownership in their communities as they are able to open restaurants, hair salons, mini marts, or any other business in their community. By opening one of these businesses the patrons feel as though they are being taken care of by someone they know, they do not have to be reliant on a big company that is impersonal and they feel might take advantage of them. Entrepreneurs always have a difficult time entering the market and remaining in business, but during the pandemic, unforeseen issues arose that threatened even the most secure small business. The challenges small businesses faced during this time, such as shutdowns, governmental regulations, and capacity restrictions, damaged many businesses and caused several to close their doors permanently. The survival techniques those who stayed in business exhibited are important to analyze. These survival techniques include offering more delivery options, switching to an online platform, and altering their business plan to focus more on risk management. The analysis of these techniques helps to understand what factors are the most important in small business survival, and what might help other businesses survive in a future similar situation.

What Problems do Small Businesses Face When Entering The Market?

Besides the business having a product that consumers in the economy want, other obstacles exist. When a small business enters the market, they face many barriers. These barriers include, but are not limited to regulation, competition, and production. These barriers alone make it difficult for small businesses to thrive, but add in unexpected factors like war and the COVID-19 pandemic and barriers become both more confusing and troublesome.

One significant barrier to entry for new businesses is the presence of established brands with strong customer loyalty. These incumbents often benefit from economies of scale, allowing them to produce goods and services at lower costs. This cost advantage can translate into lower prices for consumers, making it difficult for new entrants to compete on price alone (Yip, 1982). Additionally, established brands may have larger marketing budgets, allowing them to build brand awareness and consumer trust, further solidifying their market position and making it challenging for new businesses to gain a foothold. This creates a situation where established brands have a significant advantage in attracting and retaining customers, making it a hurdle for new businesses to overcome.

Access to capital is another barrier to entry for many small businesses. Obtaining a loan(s) or investments can be challenging for startups due to a lack of credit history or established track record. Traditional lenders may perceive them as high-risk, requiring them to offer significantly higher interest rates or collateral that new businesses entering the market may not possess. This limited access to capital restricts a small business’s ability to invest in essential resources like equipment, marketing, and inventory, hindering their ability to compete effectively with established players who have more financial resources at their disposal. The SBA understands this challenge and offers various loan programs and resources to help bridge the funding gap for small businesses.

A further impact may also be international exporting and importing. There are many resources that small businesses need to acquire to start up their business. Many of these resources can be rather expensive in the U.S., so importing them from foreign markets may prove to be beneficial and save money. Importing can prove to be very useful for companies, however; it is important to note that government regulation plays a huge role in the ease of importing for these businesses.

Assessing the Impact

The chain reaction that happened after COVID-19 arrived in the U.S. was quick and harmful to citizens and businesses. Along with the virus, nobody saw the specific impact this would have on small businesses coming. This chaos disrupted any future plans for growth for these businesses, demotivating and preventing them from growing and excelling. This reaction caused new businesses to lose hope and discouraged them from continuing on with the business.

The unprecedented nature of the pandemic caught many off guard, as its economic ramifications far exceeded initial projections. The pandemic was downplayed by some authority figures at first, causing the effects to happen harder and faster. Studies by Fairlie (2020) and Bartik et al. (2020) documented the rapid decline in business activity, widespread closures, and unprecedented job losses in the wake of the pandemic. The disruption caused by COVID-19 spread across all industries, there wasn’t a specific sector that was targeted. With sectors reliant on in-person interactions, such as hospitality, retail, and tourism, they were bearing the brunt of the economic downturn (Bartik et al., 2020).

In hospitality, restaurants, hotels, and bars rely on customers physically patronizing their establishments. However, lockdowns, social distancing measures, and fear of infection led to a sharp decline in overall traffic and revenue in all sectors. Retail similarly depends on in-person shopping experiences, but with many non-essential stores forced to close temporarily and consumers shifting to online shopping, most retail stores were facing this same loss in revenue.

The pandemic also disrupted global supply chains, causing shortages of goods and raw materials. Retailers faced difficulties in sourcing products, leading to inventory shortages and delays in fulfilling orders. Additionally, travel restrictions and border closures disrupted international trade, impacting the availability of goods and services in the tourism sector. Many tourist destinations rely heavily on imported goods and international visitors, exacerbating the economic downturn.

Moreover, the unforeseen nature of the pandemic compounded the challenges faced by businesses, exacerbating uncertainty and disrupting long-term planning efforts. The study by Papanikolaou and Schmidt (2020) underscores the impact of uncertainty on business investment decisions, with heightened uncertainty stemming from the pandemic leading to sharp declines in capital expenditure and investment activity.

During the pandemic, uncertainty reached unprecedented levels due to various factors such as volatile financial markets, unpredictable changes in consumer behavior, fluctuating government regulations, and uncertainty surrounding the duration and severity of the health crisis. This heightened uncertainty had a profound impact on businesses across industries, leading to a cautious approach towards capital expenditure and investment activity.

One way in which heightened uncertainty affects investment decisions is by increasing risk aversion among businesses. When faced with uncertain economic conditions and market volatility, companies tend to become more conservative and hesitant to commit capital to long-term investments. This reluctance to invest can manifest in various forms, such as delaying expansion projects, scaling back research and development initiatives, or postponing investments in new technologies and equipment. Furthermore, uncertainty can increase financing constraints for businesses, making it more difficult to access external funding for investment projects. Lenders and investors may become more risk-averse during periods of heightened uncertainty, leading to tighter credit conditions and higher borrowing costs for businesses. As a result, companies may face challenges in obtaining the necessary financing to pursue growth opportunities or undertake capital-intensive projects.

Despite the severity of the economic downturn, the response to COVID-19 also highlighted the resilience and adaptability of businesses. Haltiwanger et al. (2020) documented the rapid adoption of remote work arrangements, technological innovations, and shifts to online sales channels by businesses striving to remain operational amidst the crisis. These adaptations underscored the importance of agility and innovation in navigating turbulent economic environments. However, the road to recovery for businesses remains fraught with challenges. While government interventions such as the Coronavirus Aid, Relief, and Economic Security (CARES) Act provided crucial support to businesses, lingering uncertainty and the persistence of the pandemic continue to pose significant obstacles to economic recovery (Bartik et al., 2020).

While businesses demonstrated resilience and adaptability in the face of adversity, the challenges posed by the pandemic undermine the importance of targeted support measures, ongoing vigilance, and collaborative efforts to promote economic recovery and resilience in the post-pandemic era. By highlighting the role of uncertainty in shaping investment behavior, their findings provide valuable insights into the challenges that businesses face in navigating volatile and uncertain economic environments like the pandemic.

First Three Months after Widespread Social‐distancing Restrictions

Over the first three months following the imposition of these social distancing measures, the global economic sectors had to grapple with the far-reaching consequences of reduced mobility and plummeting consumer confidence. By examining the multifaceted economic impact of social-distancing restrictions, particularly focusing on the challenges faced by small businesses, and emphasizing the urgency of targeted support measures to ensure their survival and resilience in the face of adversity, something this detrimental to small businesses can be prevented from happening again.

One of the most visible effects of social distancing restrictions has been the abrupt downturn in economic activity across various sectors. Industries reliant on in-person interactions, such as hospitality, tourism, and retail, take the brunt of the economic fallout. The closure of businesses and the cancellation of events led to mass layoffs, leaving millions of workers unemployed and struggling to make ends meet. Moreover, the ripple effects of reduced consumer spending had reverberated throughout the supply chain, exacerbating the economic strain on businesses of all sizes. Fairlie’s study emphasizes the urgent need for targeted support measures to help small businesses weather the impacts of the pandemic and underscores the importance of timely intervention to ensure their survival and resilience. The study sheds light on the uneven distribution of economic hardships caused by social-distancing restrictions, with small businesses bearing a disproportionate burden. As pivotal contributors to local economies and employment, small businesses faced immense challenges in navigating the tumultuous economic landscape. With limited financial reserves and operational flexibility, they struggled to adapt to the abrupt cessation of in-person interactions and the ensuing decline in consumer demand.

The resilience of small businesses, however, should not be underestimated. Despite the unprecedented challenges they faced, many small business owners, for example local restaurant that shifted its business model to offer takeout and delivery services, exhibited adaptability and resourcefulness in their efforts to sustain operations and serve their communities. From pivoting to online sales channels to implementing innovative delivery and service models, small businesses demonstrated a remarkable capacity to evolve and innovate in response to changing circumstances. Nevertheless, the road to recovery for small businesses after the pandemic remains filled with uncertainty and obstacles.

The importance of timely intervention cannot be overstated. Delays in providing assistance to struggling small businesses may exacerbate financial distress and increase the risk of permanent closures, leading to lasting economic scarring and exacerbating disparities within communities. Fairlie’s research underscores the urgent imperative to prioritize small businesses in pandemic response and recovery efforts. By heeding the lessons learned from the first three months after the imposition of social-distancing restrictions and implementing targeted support measures, policymakers can mitigate the adverse impacts of the pandemic on small businesses, safeguard jobs, and promote economic stability and resilience in the face of adversity.

Small Business Survival Techniques

Small businesses, in particular, have been disproportionately impacted by the pandemic-induced economic downturn. With limited financial reserves and often operating on razor-thin profit margins, these smaller enterprises lack the resilience of larger corporations to survive prolonged periods of economic uncertainty. The forced closure of small businesses and the loss of revenue have threatened the existence of these businesses, jeopardizing the livelihoods of countless entrepreneurs and their employees.

Fairlie underscores the urgent need for targeted support measures to assist small businesses in weathering the impacts of the pandemic and ensuring their survival. The call for targeted support measures for small businesses is not merely a matter of economic necessity but also a matter of social equity. Small businesses serve as engines of economic growth, fostering innovation, job creation, and community development. They are integral to the fabric of our society, contributing to local economies and providing vital goods and services to communities. Without swift intervention, the economic landscape may be forever altered, with small businesses facing permanent closure along with communities dealing with the loss of jobs and essential services.

These measures, which encompass financial assistance, technical support, and resources for digital transformation, are essential for helping small businesses in the moment and also be prepared for the future. By providing targeted support, policymakers can help mitigate the adverse effects of the pandemic, preserve jobs, and sustain economic activity in communities. Kalenkoski and Pabilonia (2022) examine the far-reaching consequences of the pandemic on self-employed workers. Their study sheds light on the challenges faced by this segment of the workforce and underscores the need for targeted support measures to mitigate the adverse effects of the pandemic.

The self-employed, including freelancers, independent contractors, and small business owners, have been disproportionately impacted by the economic fallout of the pandemic. Kalenkoski and Pabilonia’s (2022) research reveals that self-employed individuals experienced significant disruptions to their livelihoods, with many facing income losses, reduced work hours, and heightened financial insecurity. The pandemic-induced economic downturn led to a decline in demand for goods and services, resulting in diminished opportunities for self-employed workers to secure contracts and projects. The nature of self-employment often entails a lack of access to employer-provided benefits such as health insurance, paid leave, and retirement savings plans. Kalenkoski and Pabilonia highlight the precarious position of self-employed individuals, who may lack a financial safety net to survive periods of income instability or cover unexpected expenses, such as medical emergencies or business disruptions.

Small businesses play a vital role in supporting local economies by generating employment opportunities and circulating money within the community. When residents patronize small businesses, their dollars are more likely to stay within the local economy, supporting other businesses and creating a multiplier effect that stimulates economic growth. Additionally, small businesses often prioritize hiring locally, providing jobs for residents and contributing to the overall prosperity of the community. Building strong relationships with customers is essential for small businesses to foster loyalty, drive repeat business, and attract new customers through word-of-mouth referrals. This may involve providing personalized customer experiences, soliciting feedback, and addressing customer concerns promptly and effectively.

The call for support measures for small businesses transcends mere economic necessity; it is a matter of social equity and community resilience. Small businesses are not just economic entities, they are integral components of the social fabric, enriching communities and enhancing quality of life. The loss of small businesses would not only have economic repercussions but also aid in the growth of monopolies.

Consumer Behavior and Shifts during COVID-19

COVID-19 presented small businesses with unprecedented economic and financial conditions. Many limitations were placed upon small businesses due to efforts to control the spread of the disease. Consumers during this time had decreased spending on goods like clothing due to it not being essential in this time of crisis. In addition, more creative niche businesses that ship worldwide suffer even more. “The export of skin and leather products, clothing, vehicles, and footwear have dropped by more than 20% since the outbreak” (Kalogiannidis,2020). Small businesses who use micro marketing to target a specific audience suffer as these products are not necessities. These statistics illustrate the disadvantage that COVID-19 brought to this sector of niche small businesses and their capabilities. As consumers made the shift away from non-necessity goods during this time, these small businesses suffered greatly.

In addition to just creative industries many U.S. small businesses and large suffered from the drop in consumption expenditure. These claims are supported by data collected by The U.S. Census Bureau. In Figure #1, Personal Consumption Expenditures dropped significantly in March 2020 which was the beginning of the COVID-19 Pandemic. It is because of this that consumers were unable to purchase non-necessity goods and services from firms at that time, however; despite this initial drop in consumption recovery appears to occur within a year, and consumption expenditures return to pre-pandemic levels, followed by the general increase in the past few decades.

Food is one of the most necessary goods for human survival, so despite the COVID-19 pandemic food must still be purchased. Households purchase food from grocery stores, restaurants, delis, and other producers. Restaurants faced some of the toughest conditions during the COVID-19 pandemic, causing them to change how they could sell their products. It is key to note that 70% of restaurants in the U.S. are single-chain operations (NRA). This is important as chain restaurants have support from the parent company during a time of crisis like this, while a single-unit restaurant has pressure to fall upon the ownership and management of the restaurant. Due to the pandemic a large share of people reported an increase in cooking at home, “A large shift in cooking at home was observed with 62% of participants reporting an increase in cooking at home compared to the same time in the previous year (Bender et al., 2022).” Due to this shift in consumption of food, restaurants suffered in retaining customers as cooking at home allowed households to feel safer than going to eat at restaurants. This shift forced many restaurants (both chain and single-unit restaurants) to lose business, and forced them to adapt to the conditions of the pandemic.

This period of COVID-19 brought about a new period that aided some new emerging businesses and consequently, also aided in some businesses exiting the marketplace. This is due to the growth of E-commerce during the pandemic. The pandemic increased a sector known as “non-store sales”, which primarily focused on all online sales. This sector experienced an 181% increase in sales over the pandemic (Fairlie & Fossen, 2022). For many sectors this proved to be a great sales boost as large chain restaurants and large grocery stores were able to get access to delivery services such as Instacart and DoorDash to meet the demands of consumers while following guidelines, however; these services were not equally distributed. “Due to high fixed costs and required knowledge, small businesses may face larger barriers to increasing their web presence, expanding takeout services or adding delivery services, and coping with uncertainty regarding liability during the health crisis (Fairlie & Fossen, 2022).” Unfortunately, these resources which in many ways kept businesses alive, were not able to be accessed by all equally which consequently hurt many businesses in both the short and long run.

A big reason why these shifts to online shopping were occuring can in large part be pinned on Amazon. During the first three months of 2021 Amazon reported a 108.5 billion dollars in sales and 8.1 billion dollars in profit. This 8.1 billion dollar profit was a 220% increase from the same time period the year prior (Weise, 2021). Due to consumers practicing caution in the presence of the pandemic, Amazon was prioritized. Small businesses during this time were not able to compete with the efficient system Amazon had for delivering goods to their customers and therefore lost business during and post-pandemic. These statistics further illustrate the consumer shift to online marketplaces as Amazon’s growth took over the market.

Overall households adopted new ways to consume during the pandemic. People developed new skills which shook up the market. Moreover, consumers started using different services to receive goods and services in response to the pandemic. The habits developed during the pandemic did not cease after the pandemic which changed the marketplace. These changes have changed the types of goods and services offered by small businesses and how they deliver them to consumers.

Rising Competition Between Businesses

The COVID-19 pandemic has not only shaken up our health systems but has also changed how businesses compete. When governments enforced social distancing and lockdowns to stop the virus, companies had to quickly adapt. The pandemic has transformed the traditional idea of competition among businesses. With economies slowing down and people spending less, companies had to rethink their plans to stay ahead in a tougher market. This made competition fiercer as firms fought for customers and survival.

From an economic standpoint, being adaptable and innovative has become crucial to staying competitive. Businesses that embraced online sales and remote work early on survived better than others. Those who diversified what they offered, changed how they got their products, and adjusted their business models, could handle the pandemic’s effects better and get ahead in the market. The pandemic also showed the importance of teamwork among businesses because while competition is still tough, firms realize the benefits of teaming up, sharing resources, and working together to overcome problems. These collaborations, like Uber Eats partnering with local restaurants to waive delivery fees and promote small businesses, helped them save money, grow, and come up with new ideas to meet people’s changing needs.

The role of governments and their policies also cannot be overlooked in shaping how businesses compete. Measures like financial aid and new rules have been crucial in helping struggling businesses, saving jobs, and making the business environment better. Government actions aimed at boosting spending, encouraging investment, and keeping markets steady have been key to lessening the pandemic’s blow on businesses and helping them get back on their feet. With economies experiencing slowdowns and consumer spending declining, companies found themselves in an intensified struggle for survival and market share. This heightened competition necessitated innovative approaches and adaptability to maintain a competitive edge in a challenging environment.

From an economic perspective, agility and innovation have emerged as critical factors for maintaining competitiveness. Businesses that swiftly embraced digital transformation, such as adopting online sales channels and facilitating remote work arrangements, were better positioned to weather the storm. For example, with gym closures and restrictions on outdoor activities, Peloton capitalized on the growing demand for at-home fitness solutions by promoting its interactive workout platform and connected exercise equipment. Enterprises that diversified their product offerings, reimagined supply chain logistics, and revamped their business models were better equipped to mitigate the adverse effects of the pandemic and seize opportunities in the evolving market landscape.

Amidst heightened competition, the pandemic underscored the value of collaboration and cooperation among businesses. While maintaining competitiveness remains paramount, firms recognized the benefits of strategic alliances, resource-sharing initiatives, and collective problem-solving endeavors. These boosted collaborative efforts not only helped businesses streamline operations, reduce costs, and foster innovation but also enabled them to address emerging consumer needs more effectively.

What Factors Affect Small Business Survival or Destruction the Most?

Many types of small businesses exist, some provide specialized services, and others unique goods that big businesses might not offer. The largest factor is of course profit, in order for a business to continue operations and be deemed successful it must be making money. During the pandemic new factors put into place by the government shook up the operating ability of businesses during the pandemic.

A large part of the COVID-19 pandemic and the survival of small businesses was whether or not they were deemed “essential” or “non-essential”. If a business is deemed “non-essential”, it must adhere to guidelines established by the state they are in. These were seen in most clothing stores which saw a 54.5% decrease from March 2019 to March 2020 and 47.4% in the food services industry (Fairlie & Fossen, 2022). Both of these sectors were seen as “non-essential” by the government as clothing was not a necessity and sit-down food service came with great risk of spreading the virus. On the other hand, “The sectors of agriculture, building materials, pharmacies, garden centers, supermarkets, and even liquor stores were deemed “essential” and experienced positive sales growth from 2019 Q2 to 2020 Q2 (Fairlie & Fossen, 2022).” These stores which sell necessity goods like medicine and food were deemed essential and therefore could continue business.

In addition to a business being non-essential some small businesses were closed temporarily due to the pandemic. A survey was designed to capture the amount of businesses that closed down due to the pandemic, this survey was sent to over 5,800 small businesses. Using the data collected within the survey the authors found that 41.3% of small businesses reported being temporarily shut down during the pandemic, however; a smaller share of 1.8% were permanently shut down during the pandemic(Bartik et. al., 2020). While it is comforting that only 1.8% of small businesses were permanently shut down, the 41.3% that were temporary were at risk of losing customers to other businesses who were open. In addition to this, consumer shifts may also adversely affect their business, as these shifts have been observed to carry over after the pandemic ended.

One of the early goals any small business has is capturing value. The value is ultimately determined by customer perception and their willingness to pay. Small businesses should aim to produce goods or services with sufficient demand to avoid excessive unplanned inventories. Unplanned inventories tie up resources that could be used for other purposes, impacting a company’s financial flexibility. Since emerging small businesses usually have only a limited amount of resources, minimizing the loss of these is crucial for survival. While this principle can be a crippling factor to many businesses, it can also benefit many businesses who saw the COVID-19 pandemic as an opportunity to capture the demands of the consumer and create a thriving business.

Conditions of small businesses vary state by state in the U.S., regulations exist that make each small business’s rules different. During the COVID-19 pandemic we see different states handle it differently. Each state has different regulations for businesses on how and even if they could open back up. For example, small independent restaurants were instructed by their given state on their total capacity and how they could deliver their services.

Post-Pandemic Supply Chain Disruptions

Following the pandemic, many key industries were not able to acquire the necessary materials needed to produce for their small business. Post-pandemic the U.S. relations with China remained low, this caused trade to be significantly decreased. For small businesses who relied on imports from China, Italy, and Japan their businesses would take perhaps the biggest toll as they were not able to acquire the materials needed to produce and make a profit. Highly exposed sectors were to fire more workers and produce less output (Meier & Pinto, 2021). These sectors contained larger workforce reductions, decreased exports, and lower imports.

One of the largest industries to suffer from post pandemic supply shocks was the automotive industry. In this scenario, there is evidence that it was in part the firm’s fault that automobiles were experiencing a shortage. This is due to automakers having perceived the idea that their products would not be as much in demand, therefore they canceled orders of semiconductors (Helper & Soltas, 2021). This misconception in demand for a product made it increasingly difficult for automakers to produce the necessary inventory needed to meet the demand of the consumers. For small businesses this further increases the cost of buying additional transportation units to start or maintain their small business.

While these findings may prove to be troublesome, these are only applicable in the short term. While it is true that during March and April of 2020 industrial production growth was affected negatively, the effects of the supply chain shortages had become insignificant as of July 2020. The effect of COVID-19 on the supply chain in the U.S. is significantly better, considering the damage the pandemic did. The supply chain issue with respect to China wears off in about 5 to 6 months while a natural disaster usually takes a year to recover from.

While these supply chain issues existed during this period, there was also a public misconception about many items people saw a shortage in. Food is one of these items that many perceived as a shortage during the Pandemic, however; this may not be the case. As discussed earlier many consumers shifted to grocery shopping and developed food preparation skills. Due to this shift, studies show that the misconception of food shortages during the COVID-19 pandemic was associated with people having less time to shop and the fear of contracting the virus while shopping for groceries (Bender et al., 2022). Both of these factors did not allow the consumer to properly assess the market for shortages and hurt both chain owned and single operated supermarkets, as well as other food distributors.

Compliance with Health and Safety Protocols

During the pandemic, there were many health and safety protocols put in place to prevent the spread of COVID-19. Businesses across the country had to comply with the regulations put in place by the federal government and many had to comply with state regulations as well. Many businesses had to find new ways of structuring themselves. This includes switching to an online platform, maintaining and creating more delivery options, and shifting from an in-person work environment to one that was online, even if it was just for an initial short period.

OSHA, the Occupational Health and Safety Admission, announced in 2020 a guideline for all employers in response to the pandemic. This guideline informs employers that they should create an infectious disease preparedness and response plan for their business, become stricter with the implementation of basic infection prevention measures, develop policies and procedures for the identification and isolation of sick people, and develop, implement, and communicate workplace flexibilities and protections, implement workplace controls, and continue to follow other OSHA guidelines. These plans and procedures that employers were supposed to create were for the safety of their employees, the customers, and themselves.

However beneficial these protocols were, they made operations more difficult for small businesses than for other larger companies that were able to adopt new procedures more easily. This ease was due in part to the availability and amount of resources larger businesses were able to utilize when new policies were being implemented. Larger businesses simply have more money, more employees, and more access to cost-efficient methods that allow them to implement any new policy that OSHA announced. These businesses are also more resilient in the market because of their size, a negative impact may cause losses, but it will not necessarily cripple them as it would for a small business. Small businesses are less resilient in the market and do not have the same resources that larger businesses do. This put them at a disadvantage during the pandemic, they were not able to implement the new regulations as easily, nor were they able to change their business structure as easily to mitigate the losses they were incurring. Fairlie, et al., (2023) discuss the limitations small businesses face, they found that “the fragility of small businesses in comparison to large businesses outweighs their higher flexibility when facing a large aggregate negative shock such as a health crisis.”

Government-imposed shutdowns and mandates about how many people could be in an enclosed space also impacted small businesses. Owners had to alter how they did business, some were only open certain days of the week, while others adjusted the hours they were open during the day. Most were able to adopt delivery options which helped compensate for losses incurred from people not going out and shopping as they did before the pandemic. However, not everyone was able to adapt easily, Fairlie, et al., (2023) discuss this issue stating that “Due to high fixed costs and required knowledge, small businesses may have faced larger barriers to increasing their web presence, expanding takeout services or adding delivery services, and coping with uncertainty regarding liability.” These changes had to be adopted rapidly and they require money, human capital, and time. Though businesses that were in good standing before the pandemic were able to alter their operations smoothly, others struggled and were not able to adapt which caused their decline and increased their risk of permanent closure.

Those that were able to adopt new operational methods such as delivery options saw great success and many businesses adopted them seeing the success other businesses were having. As the initial shutdowns were imposed, businesses were not sure when they would be able to reopen and due to this uncertainty, they tried to find alternatives to their storefronts. This sparked a great increase in online platforms for businesses, with an online store a business was able to have a similar amount of purchases without having to try to keep their doors open. With lenient return policies companies were able to entice customers to purchase while still being able to look at or try out the product before the decision was final. The ability to have an online store instead of a storefront also limited the number of employees a business needed. They required employees to prepare and package orders, but they no longer needed sales representatives. This was actually helpful in complying with the regulations limiting how many people could be in an enclosed space at a time.

Differences Before and After the Pandemic

There are several differences for small businesses in the post-pandemic world compared to the pre-pandemic world. In the post-pandemic world, many businesses are run primarily online instead of in-person as was custom before. Parker et al. (2023) discuss the transition to online platforms stating that “after the pandemic hit, 70% of small businesses either quickly introduced digital technologies or increased their digitalisation due to the COVID-19 pandemic.” These businesses may also currently hire fewer workers as they have been able to navigate the market during the pandemic with fewer workers. It is now much easier to find a business that provides a delivery or pickup service, and return policies have been altered to incentivize people to continue to shop even if they cannot try items out in a store first. Businesses have adopted many different plans and procedures that helped them through the pandemic which have continued to help them in the post-pandemic era. One of the biggest changes was altering their business plans to focus on risk management and survival instead of profit maximization.

This change of focus to risk management is what allowed many businesses to survive the pandemic. By focusing on what risks might occur in the future and mitigating those risks, small businesses are setting themselves up for success should another negative shock hit the market. The focus on these risks now, during a relatively stable time, helps businesses develop several plans and strategies that are cost-efficient and easily implemented. Bocanet, et al., discuss this in Business Analysis in Post-Pandemic Era (2021), they found that “businesses need to secure organizational resilience and risk management in order to survive. This is because a businesses’ inherent resilience determines its chance at success and is a measure of durability during a crisis.” By focusing on risk management and resilience, small businesses have been able to become more secure in the market and more prepared for any adverse shocks. These authors also find that “The resilience and vulnerability of businesses determine how the pandemic will impact their operations.” (Boncanet, et al., 2021) Helping us to understand that businesses that were more impacted by the pandemic are those more likely the be changing their operational structure now.

There is a concern that many of the small businesses that prospered before the pandemic have had to permanently close after the difficulties they faced. However, many of these closures were temporary, others closed their storefronts permanently while becoming much more active with their online stores. Fairlie, et al., (2023) discuss the probability that a small business closed permanently during that time. The authors found that after the initial shock which saw a dramatic increase in small business closures, the rate dropped back to pre-pandemic levels by the third quarter of 2020. Indicating that as the initial shutdowns ended businesses were able to start to bounce back.

How Have Businesses Overcome the Problems They Faced?

Small businesses have shown a great ability to overcome the problems they have faced during the pandemic. Some of the problems that small businesses faced included those that were forced upon them by government regulations. There could only be a certain number of people in a space at a time, which meant that only a certain number of customers could enter and a certain number of workers could work in person. Other problems included that they had to switch to a more online presence instead of in-person in a storefront. These businesses had to create a website for their store, learn how to advertise the new website, and make sure that people were able to have an easy and pleasant experience. Fairlie, et al., (2023) discuss some of the challenges that small businesses faced at the time, stating that “Customers in general might have felt fewer health concerns shopping in large retailers instead of small shops.” This aversion to shopping at a small business for fear of the spread of COVID-19 in favor of larger businesses created more competition for small businesses which many could not withstand.

There are several ways that small businesses have found to overcome the challenges they faced. These include switching to an online platform or offering delivery options to their customers, as well as the ability of a small business to be flexible and shift their business plans to adapt to the new regulations. Crick, et al., (2023) discuss this, they found that strategic flexibility enabled small businesses to develop resilience during the time, the owners had to be able to adjust their plans to accommodate the new regulations and the public mood.

Adapting to the customer’s preferences is something that has helped businesses survive throughout time. Altering how the business operates to increase customer satisfaction is an important tactic to remain successful in a time of turmoil. Many of the businesses that did well during the pandemic already had, or were able to create an online platform and delivery option. Most people did not want to risk getting themselves or their loved ones sick. Many did not leave their homes very often because of this, as the pandemic progressed you were able to order almost anything you could want through the internet and have it delivered to you. Customers still wanted to consume and so businesses adapted to allow them to do that from the safety of their own homes.

Another strategy small businesses used to overcome the challenges of the time was to form relationships with other businesses. Some businesses paired up with others to use the same online platform so that customers had easy access online to complementary goods. This also decreased the cost of developing the online platform for the businesses as they could not split the cost between themselves. Crick, et al., (2023) discuss this in Staying Alive: Coopetition and Competitor Oriented Behaviour from a Pre- to Post-COVID-19 Pandemic Era. The authors were able to determine that small businesses benefited greatly from a competitor orientation, stating that “a competitor orientation is likely to help owners to decide who best to form collaborative relationships with and the magnitude of such activities.” This way of operation allows a business to determine which companies will help them succeed and surpass other competitors which helps them remain profitable in times of turmoil such as the pandemic.

Difficulty Accessing Financing and Credit

Many small businesses suffered during the pandemic due to a lack of funds, there were several programs, such as the CARES Act, put in place to help these businesses financially. However, these programs were imperfect and had several issues allocating resources to those who needed them the most. Banks tended to give loans to those with whom they were already doing business, this made it so that businesses that were struggling and needed the money were less likely to receive funds. This particular issue was fixed later in the pandemic and many of the businesses that were denied loans previously were able to receive them.

There was a great inequality seen in the availability of funds during the pandemic, particularly to whom those funds were available. Black communities were hit hard by the pandemic, both through increased rates of the disease and a larger economic impact. McKoy (2022) discusses how black communities were affected by the governmental programs enacted and the future outlook for black-owned small businesses. McKoy was able to find that black-owned businesses saw the greatest rate of decline during the pandemic. The higher rates of the disease played a role in this. People were afraid to go out and purchase goods or services anywhere. Not to mention they were hit hard with unemployment rates which left them with little excess funds to buy much more than the necessities. The community’s inability to shop at small businesses and the lack of initial government aid for black-owned businesses caused many to struggle and close during this time. The lack of initial government aid for black-owned businesses was due to factors such as the governmental assistance programs such as PPP loans left out sole proprietorships. This is thought to be the cause of the disparity shown as 96 percent of black-owned businesses are sole proprietorships. This meant that 96 percent of black-owned businesses were unable to receive initial aid through PPP loans. This caused many to struggle at the time and even lose faith that they would receive government assistance and be able to continue operations.

Overall, McKoy is able to conclude that black-owned businesses ultimately will be able to bounce back from the pandemic and continue to grow in the future. This is in part due to the support they receive from their communities, as many would prefer to purchase from black-owned businesses in their neighborhoods. This structure of support and the eventual aid that their businesses received allowed for many businesses that were forced to close to reopen during and after the pandemic.

The condition of financials in a business is very important to predict the future failures or success of an ongoing business. Business owners need to have proper management of funds circulating within the business to ensure continuous investments to grow the business. However, business owners must save up an emergency stack of liquid cash within the business which they could rely on for a certain time. The survival of the business post COVID-19 pandemic, directly and indirectly, depended on the financial fragility of the business owners who now had to manage their businesses with no cash inflows, new safety regulations, and no guaranteed end date for the pandemic. The direct effects of lack of financials are clear to understand and visualize but understanding some of the indirect effects of financial fragility is not easy.

One approach is to observe the human behaviors that would worsen the chances of a business surviving. Furthermore, Scholars agree that small firms’ survival depends on the owner’s psychology (Doern, 2016, Prayag et al., 2020). A sudden pandemic situation on the rise is certain to bring huge responsibilities and stress onto the shoulders of small business owners. This would force the owners to be psychologically resilient and make certain sacrifices along with hard decisions to ensure the survival of their businesses. Robertson et al. (2015), bring up two perspectives on psychological resilience. In the first perspective, resilience is thought of as a characteristic people naturally have whereas in the second perspective, it is viewed as something that can be developed over time.

According to the Broaden & Build idea, people’s minds become more open when they experience happy or exciting feelings. Their ability to think creatively and from several perspectives increases. They can solve difficulties and come up with superior ideas as a result. Conversely, people tend to focus less when they are experiencing unpleasant emotions like anger or fear. They simply notice the current issue and act without thinking, which makes it difficult to come up with answers.

During and after the COVID-19 pandemic, company owners may greatly benefit from having a positive outlook, particularly in trying times like this epidemic. They are more likely to recognize chances and take proactive measures to better their circumstances when they are feeling optimistic. In particular, resilient company entrepreneurs are adept at maintaining their optimism in the face of adversity. They view obstacles as something they can conquer rather than as a roadblock and are full of optimism. They are more likely to make wise business decisions as a result of this thinking, which raises their chances of surviving trying times like the epidemic.

Furthermore, another study takes into account Self-organizing maps (SOMs) which is a type of Artificial Neural Network that groups patterns based on their similarities and were able to find that there is a big significance of internal fundamentals and resilience in being successful post-pandemic. In particular, it brought to light distinct patterns of a successful business which were firstly having access to financing, having a strong and experienced management team, and an innovative internal production process combined with strategies to overcome the situation to achieve success.

Starting with firm age, was a key factor that separated successful firms from failures. It was found that successful firms were comparatively older and mature. Whereas businesses that failed were relatively young startups. This could be linked to having good financial resilience, as older firms had a larger period to Save up emergency funds which could support their firms in such a scenario whereas younger start-ups might not have had the required periods to save up the necessary funds for the COVID-19 pandemic.

Secondly, some studies[1] included the impact of the number of employees on the probability of success post-pandemic. The study predicts that a higher number of employees would mean higher labor costs. Which would result in another cost for the business. Meanwhile, businesses with a smaller number of employees had to deal with lower labor cost. That said, there were indeed many companies that had to lay off employees due to this factor. Therefore, looking closely at this decision boils down to the mental resilience of small business owners. On how they could make the necessary layoffs without being emotionally drawn back by the decision.

Thirdly, several studies[2] highlighted the importance of marketing strategies along with the importance of purchasing policies, delivery systems, and the ability to adapt to new problems to capture new market niches. For instance, small business owners had to develop the skills to take their businesses online to survive. It is possible that some businesses were harder to implement online, however, it again would narrow down to how fast the small business owners were able to shift their existing business models to incorporate them into online models and create a new cash flow.

Running a search within the small business administration database for companies with less than one thousand five hundred and an annual revenue of less than hundred thousand USD which still operate as of now, showed evidence that the companies currently operating within New York surprisingly comprises mostly a list of cleaning and tech-related industries. Moreover, observing some of their income statements they did not suffer a loss of income during the pandemic years of 2020. Therefore, it is clear that some small businesses have a large advantage. Especially in the case of cleaning services, businesses were now gaining a profit sanitizing compartments compromised by COVID-19.

Another interesting small business that thrived during the pandemic was “eplastics” ( https://www.eplastics.com/) which was a company designated to create safety masks, plastic shields, and covers for COVID–19 safety regulations. Meanwhile, small businesses such as coffee café and restaurants had a loss in cash flow due to customers not being able to go outside.

For these small businesses that were losing money, the CARES Act significantly reduced the impact. There were three reliefs included for small businesses; these were Paycheck Protection Programs (PPP), Small Business Administration Loans ( SBA), and Emergency Economic Injury Grants.

The Paycheck Protection Program was dedicated to cushioning job retention and business operating expenses, a total of $349 million in total was put forward towards small businesses to borrow as loans up to 10 million based on average monthly payroll costs. Moreover, To further lessen the blow on small firms that employ SBA loan products an additional $17 billion was put forward. As mandated by law, the SBA will pay back principal, interest, and fees on existing SBA loans for a period of six months. The loan amount is determined by averaging all payroll payments for the twelve weeks starting on February 15, 2019, or, if the qualified recipient chooses, March 1, 2019, and ending on June 30, 2019.

These funds could have provided hope for small business owners who were failing their businesses which in turn could have affected their psychological states into a more positive state which would have triggered a positive outlook as mentioned before to produce a newer and successful business model which would be less affected by pandemic conditions.

For businesses to mitigate future impacts from natural disasters such as the covid-19 pandemic it is important to plan for long term sustainability. To withstand economic fluctuations there are several things a firm could do. Firstly, it was observed that businesses which had more than one source of revenue did better than those with a single source of income. For instance taking into consideration restaurants which had an online food ordering and delivery system were in better standing after the pandemic when compared to restaurants which did not offer an online ordering system. Secondly, companies which had built a strong and lasting relationship with their customers and supplies were among the first to receive income after the covid restrictions were taken off. This managed to bring up the income levels of the small business fast enough to pay off their debts in time and prevent the owners from going bankrupt.

During the pandemic there were many barriers put on the imports and exports of countries. Many small businesses which relied on exporting their products or importing the necessary spare parts for the operations of their business were now cut off. The business which managed to make alternative means for those exports and imports now had the chance to re-establish the lost exports and import trades as they were opening up post pandemic. Therefore to ensure the success of business post pandemic it is important for business owners to be aware and up to date on the latest information regarding the Trade routes which are opening. Smart small business owners were good at identifying these new import/export routes and had made a good profit by building connections on time and getting their products imported or exported to the right place at the right time.

Furthermore, labor market dynamics post-pandemic were much different from pre-pandemic. The labor market now consisted of an introduction of remote work which meant that in order to attract new talent and retain talent, small business owners had to invest in training and exploring flexible work arrangements to meet the changing needs of the labor markets. Small businesses which managed to engage in a good work environment benefited from a motivated workforce and efficient operations of the business.

Another important aspect which small business needed to have an understanding on was the inflation and interest rates. These had a big impact on the borrowing costs, consumer purchasing power and the different pricing strategies which the small business had to encounter and adapt accordingly. For instance , due to inflation the purchasing power of many customers now had dropped, businesses which sold inferior goods were now in danger of going out of business. Therefore it was necessary for businesses to market their goods in such a way that it becomes a normal good. For example, small businesses that traditionally produced canned goods, often considered inferior products, have adapted by capitalizing on the fear of running out of fresh food stocks. They are now selling their canned goods in bulk, leveraging the fact that canned products have a much longer shelf life compared to fresh stocks.

Real Data Analysis

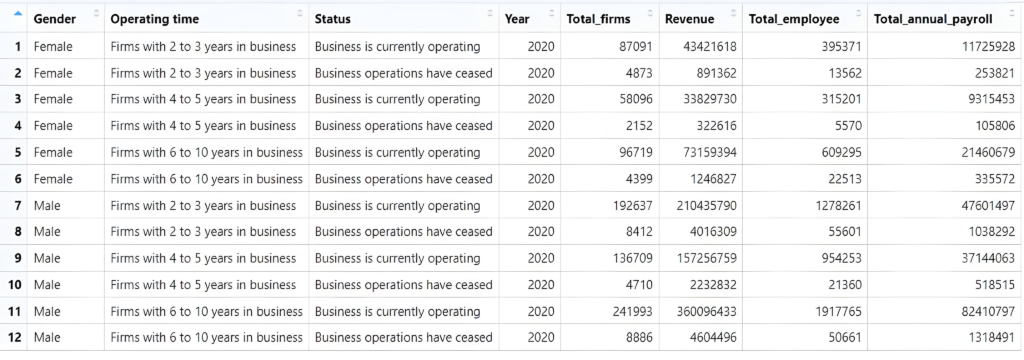

Data with the filter “small business” were gathered and summarized from the United states census bureau for the years 2019, 2020 and 2021. The following tables were created using R- studio. The data contains the variables.

- Gender : Male/Female

- Operating time : 2-3 / 4-5 / 6-10 Years

- Status : Whether the business has ceased in the current year or if its still operating

- Year

- Total number of firms

- Revenue

- Total Employees

- Annual payroll

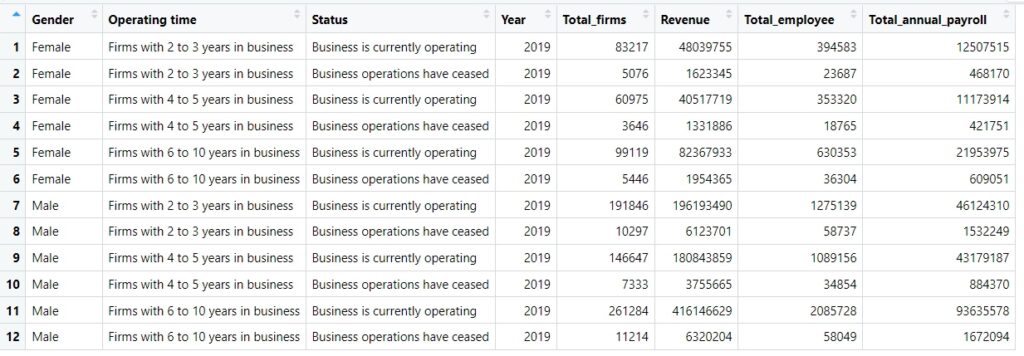

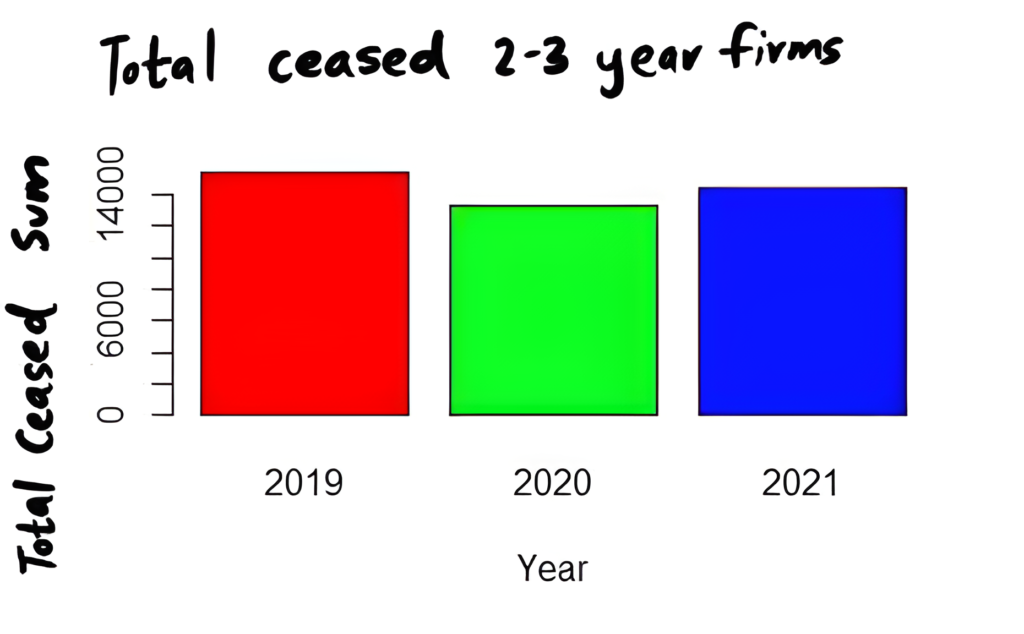

Analysis from this data was made in such a way that splits the data into business operating for 2-3 years, 4-5 years and 6-10 years, after which the total number of businesses which had ceased their operations for the years 2019 , 2020 and 2021 were formed. The first barplot show the total number of firms for which business ceased for firms running for 2-3 years.

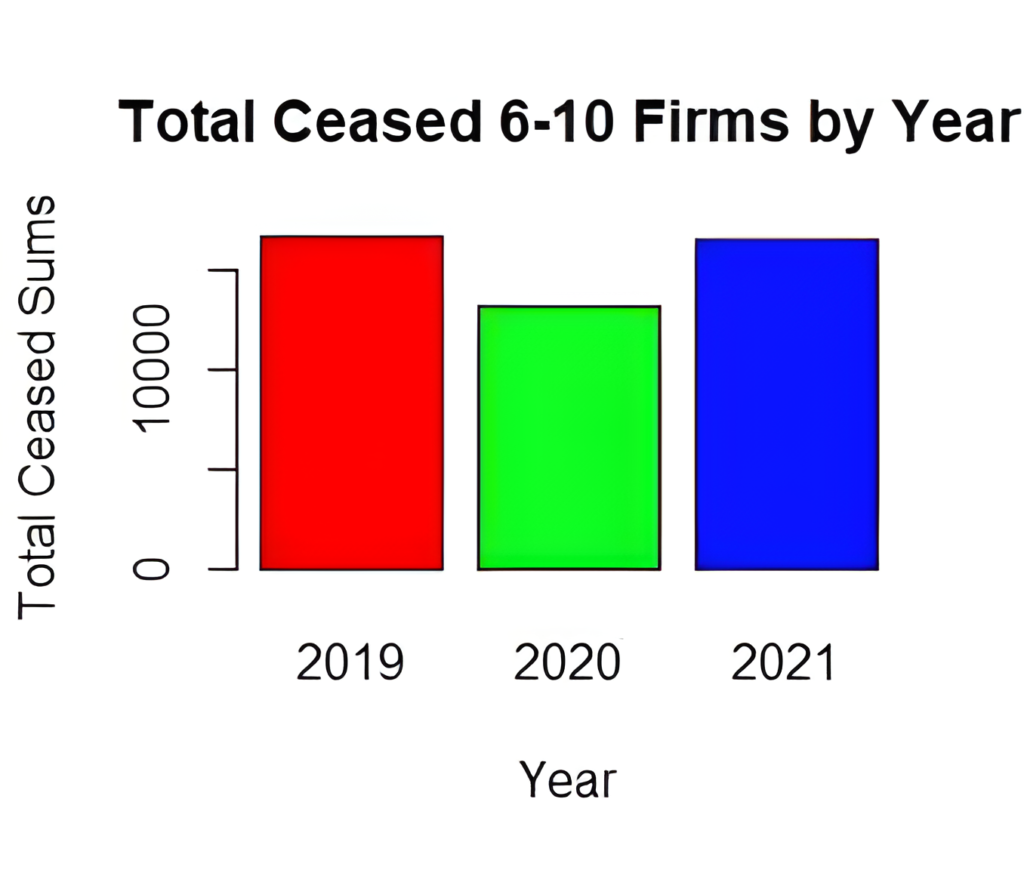

A second bar plot was created for the firms which were running for 4-5 years, and a final barplot was created for the firms which were running for 6-10 years.Both of which are shown below.

Considering that there are a higher number of start up businesses within an economy compared to older businesses explains why the numbers of businesses which ceased were the highest for the 2-3 year business. Whereas the least total number of businesses which reported as being ceased were found in the businesses which were running for 4-5 years.The total number of operating firms which were 4-5 years old were also the lowest among currently operating. This suggests that there is not much 4-5 year old business in an economy.

Furthermore, it shows that the highest number of businesses which reported that they had ceased operations were in the year of 2019, followed by the year of 2021. The least number was during the pandemic year. This shows evidence that businesses which had made it to the year 2020 by adapting alternative ways of doing business had a lesser chance of being impacted by side effects of the pandemic such as loss of labor and restriction of imports/exports.

Moving on to the year of 2021 we see an increase in the number of businesses ceased which is almost similar to the year of 2019. One possible way to explain this is to consider the second waves and the different variants of the pandemic. Businesses had started to open up during the year of 2021 due to the introduction of vaccines and protective measures. However, further into the year these businesses had to be shut down once again due to the spread of different variants which the vaccines were not much effective on.

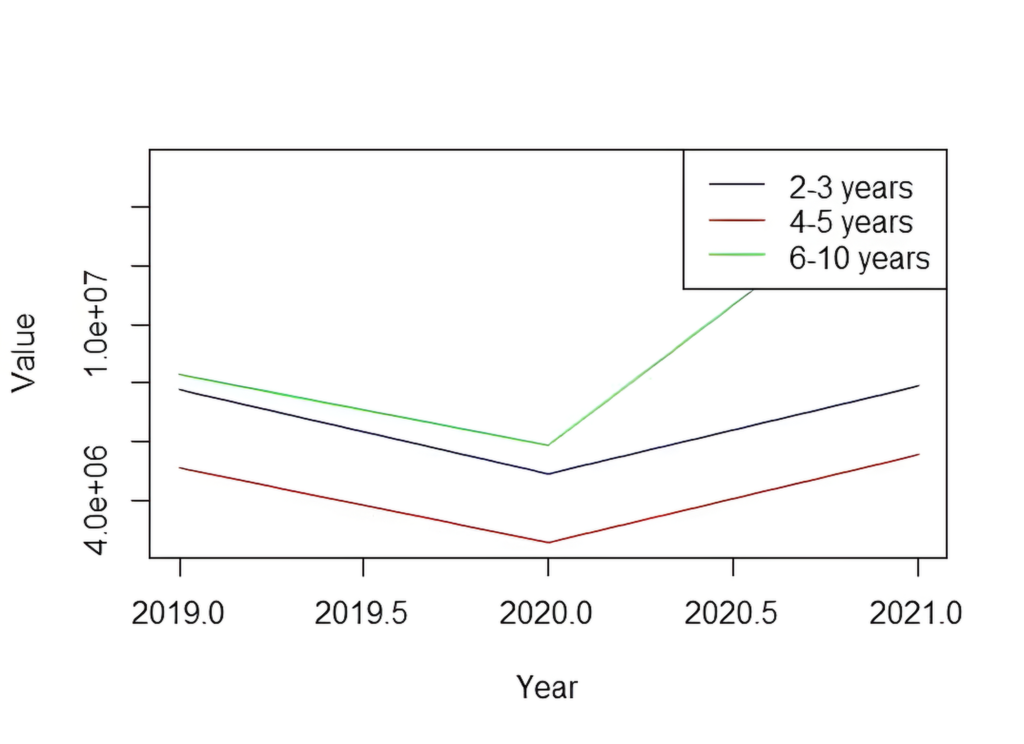

Therefore, it would be recommended that in order for a small business to survive a pandemic it would be better off to invest in new technologies which allow them to do their business online without expecting the pandemic to die down. To analyze the trends in revenues and total employees data, data was arranged into the following format. Which gives business which are still operating on one table and the business which have ceased to operate on the other categorized by the operating time of the business.

Line plots for the following tables were added to see the revenue and employment trends with the year for business operating from 2-3 years, 4-5 years and 6-10 years. Line diagram below plots the revenue for businesses which are still operating and which have ceased. It is clear to see that all firms which ceased to operate had suffered some dip in revenues in the year 2020. However, looking at the firms which are 2-3 years old and still operating we cannot see a dip in revenues for the year 2020. Whereas we could see a revenue dips in both 4-5 year and 6-10 years firms which are still operating. This agrees with the thought that older, more mature small businesses have a high resilience towards financial losses increasing the odds of surviving a pandemic.

This dataset used for the paper has some limitations, One of which is that the effects on individual sectors of small business are not separated. Furthermore, This data is within the United States economy, therefore the effects might vary for small businesses within other countries or other economies. Howere, using this dataset we have a glimpse of what is necessary for the survival of a small business post pandemic.

Opportunities, Threats, and Risks of Implementation of Technologies in the Post-Pandemic Period COVID-19

The resistance to change and threats from implementations after the pandemic were detrimental to the economic sector. The competitiveness draws out many small businesses and feeds into monopolies. The pandemic has accelerated the adoption of technology across various sectors, ushering in a new era of digital transformation. While the implementation of technologies presents numerous opportunities for businesses and society as a whole, it also comes with inherent threats and risks.

The integration of innovative technologies post-pandemic brings about inherent risks, as highlighted by Illiashenko et al. One prominent concern is the concentration of market power and the proliferation of monopolistic tendencies. In the pursuit of competitiveness, small businesses may inadvertently contribute to market consolidation, allowing larger firms to monopolize industries. This monopolization stifles competition and innovation, posing a significant threat to the diversity and dynamism of the business landscape. Consequently, small businesses face heightened challenges in maintaining their market presence and may experience exacerbated inequalities, like access to resources or market opportunities, within the ecosystem.

Despite the potential benefits, the adoption of innovative technologies is not without its challenges. Illiashenko et al. highlights the resistance to change as a significant barrier to the successful implementation of new technologies in small businesses. Employees may be reluctant to embrace unfamiliar systems or processes, fearing disruptions to established workflows or job insecurity. Overcoming this resistance requires effective change management strategies, clear communication, and investment in employee training and development. Illiashenko et al. also caution against the threats posed by the concentration of market power and the emergence of monopolistic tendencies. As small businesses strive to remain competitive, there is a risk of market consolidation, where larger firms leverage their resources and scale to dominate markets, stifling competition and innovation in the process. This trend towards consolidation could have far-reaching implications for small businesses, limiting their ability to compete and potentially exacerbating inequalities within the business ecosystem.

Despite these challenges, small businesses must navigate the post-pandemic landscape with resilience and strategic foresight. While the implementation of innovative technologies may present risks, it also offers opportunities for small businesses to differentiate themselves, innovate, and carve out a niche in the market. By leveraging technology to enhance customer experiences, optimize operations, and drive growth, small businesses can position themselves for long-term success in the post-pandemic era.

Policymakers and industry stakeholders play a crucial role in fostering an environment conducive to small business innovation and competitiveness. Measures to promote fair competition, support access to capital and resources, and incentivize innovation can help level the playing field and empower small businesses to thrive in the digital age. Additionally, collaboration and knowledge-sharing initiatives within the small business community can facilitate collective learning and resource pooling, enabling small businesses to overcome common challenges and seize opportunities for growth.

While the implementation of technologies in the post-pandemic period offers numerous opportunities for advancement and growth, it also brings with it significant threats and risks that must be carefully managed. By addressing resistance to change and mitigating risks of market concentration proactively and responsibly, businesses and policymakers can harness the transformative power of technology to create a more resilient, inclusive, and sustainable future.

Conclusion

In conclusion, the effect that COVID-19 had on small businesses was detrimental and continues to affect those already in the market and emerging businesses. The evidence provided displays a significant change in how households interact with firms. This change is even more significant considering the amount of time the virus took place. Despite this, the economy of the U.S. was resilient and was able to recover quickly, due to great enforcement of policy and keeping the public trust with the economy.

This analysis shows a great number of situations where the government enforced regulations to keep people safe while attempting to help businesses survive. Many health and safety regulations were put in place in order to stop the spread of the virus. These protocols were strict and many businesses were forced to permanently close due to a variety of reasons, including that they did not have the funds to withstand the initial shutdowns. However, the resilience of these businesses and the changes they were able to make to their structure allowed many other small businesses to survive the pandemic and become more successful in the long run.

In addition to government mandates, it is evident that consumer shifts played a large role in small business survival. Consumers who were acting rational tended to move their shopping online, this was perhaps easier due to money received by the CARES Act. This online shift unfortunately greatly affected large businesses such as Amazon, while hurting the small businesses that offered many of the same products. In addition the adoption of new methods by consumers such as adopting hobbies and preparing their own food both hurt and helped sectors of agriculture and food. Finally it is evident that these shifts that occurred during the pandemic carried over to the post pandemic period.

Government policies like the CARES Act and increased accessibility to loans during the pandemic allowed businesses to survive and expand upon their services to meet the evolving consumers’ wants and needs during this health crisis. There were problems with these acts, at first they did not reach all small business owners and disproportionately left out poor and black communities. This caused businesses in these communities to struggle more than others and increased their risk of closing. Eventually these acts incorporated all small businesses and these communities have been able to bounce back.

Despite the helpful government intervention, small businesses have had to alter the way they operate, switching to a more prominent online presence. Those who were able to couple their increased online presence with increased delivery options and a lenient return policy were able to see more success during this time than those who were unable to adopt new methods of operation. Adopting the new methods required an influx of human capital, money, and time that some small businesses did not have the luxury of spending. This is why large businesses that had more resources to spend were able to withstand the pandemic more easily than small businesses.

Looking forward, it’s important for governments and businesses to work together and be ready to adapt to future challenges. By learning from the pandemic and encouraging innovation, society can recover and make our economy stronger after the crisis. Small businesses have overcome many challenges during the pandemic. Through changing their business plans, switching to online platforms and offering delivery services, creating relationships with other companies, and focusing on risk management many were able to conquer their unique challenges. A combination of these methods was more beneficial than a single method adopted, but even a single method helped to increase their chances of survival at the time. The pandemic has helped small businesses to be more prepared for a similar situation in the future and increase their resilience.

References

Akpan, Ikpe Justice, et al. “Towards Developing a Knowledge Base for Small Business Survival Techniques during COVID-19 and Sustainable Growth Strategies for the Post-Pandemic Era.” Journal of Small Business & Entrepreneurship, July 2023, pp. 1–23.

Altman, E. I., Balzano, M., Giannozzi, A., & Srhoj, S. (2023). Revisiting SME default predictors: The omega score. Journal of small business management, 61(6), 2383-2417.

Bannerman, G. (2017, November 9). The impact of war: New Business networks and small-scale contractors in Britain, 1739-1770.

Bartik, A. W., Bertrand, M., Cullen, Z. B., Glaeser, E. L., Luca, M., & Stanton, C. (2020). The Impact of COVID-19 on Small Business Outcomes and Expectations. Proceedings of the National Academy of Sciences, 117(30), 17656–17666.

Belitski, M., Guenther, C., Kritikos, A. S., & Thurik, R. (2021, september). Economic effects of the COVID-19 pandemic on entrepreneurship and small businesses.

Bender, K. E., Badiger, A., Roe, B. E., Shu, Y., & Qi, D. (2022, August). Consumer behavior during the COVID-19 pandemic: An analysis of food purchasing and management behaviors in U.S. households through the lens of food system resilience. Socio-Economic Planning Sciences

Bocanet, A., Alpenidze, O., & Badran, O. (2021). Business analysis in post-pandemic era. Academy of Strategic Management Journal, 20(4), 1-9.

Chhatwani, M., Mishra, S. K., Arup, V., & Rai, H. (2022, March). Psychological resilience and business survival chances: A study of small firms in the USA during COVID-19.

Chowdhury, Priyabrata, et al. “COVID-19 Pandemic Related Supply Chain Studies: A Systematic Review.” Transportation Research Part E: Logistics and Transportation Review, vol. 148, Apr. 2021, p. 102271. ScienceDirect

Crick, J. M., Crick, D., & Chaudhry, S. (2023). Staying alive: Coopetition and competitor oriented behaviour from a pre- to post covid-19 pandemic era. Industrial Marketing Management, 113, 58–73.

Eschker, E., Gold, G., & Lane, M. D. (2017). Rural entrepreneurs: what are the best indicators of their success?. Journal of Small Business and Enterprise Development, 24(2), 278-296.

Fairlie, Robert. “The Impact of COVID‐19 on Small Business Owners: Evidence from the First Three Months after Widespread Social‐distancing Restrictions.” Journal of Economics & Management Strategy, vol. 29, no. 4, Oct. 2020, pp. 727–40. DOI.org (Crossref),

Fairlie, R., & Fossen, F. M. (2022, March 31). The early impacts of the COVID-19 pandemic on business sales. The Journal of Small Business Economics.

Fairlie, R., Fossen, F. M., Johnsen, R., & Droboniku, G. (2023). Were small businesses more likely to permanently close in the pandemic?. Small Business Economics, 60(4), 1613-1629.

Ghosh, B. C., Liang, T. W., Meng, T. T., & Chan, B. (2001). The key success factors, distinctive capabilities, and strategic thrusts of top SMEs in Singapore. Journal of Business Research, 51(3), 209-221.

Hadjielias, E., Christofi, M., & Tarba, S. (2022, January 22). Contextualizing small business resilience during the COVID-19 pandemic; evidence from small business owner-managers.

Hait, A. W. (2021, January 19). What is a Small Business? Census Bureau.

Halabí, C. E., & Lussier, R. N. (2014). A model for predicting small firm performance: Increasing the probability of entrepreneurial success in Chile. Journal of Small Business and Enterprise Development, 21(1), 4-25.

Haltiwanger, J., Jarmin, R. S., Kulick, R., & Miranda, J. (2020). High-Frequency Business Dynamics and Job Reallocation: The Importance of Entrepreneurial Agility. Proceedings of the National Academy of Sciences, 117(30), 17670–17676.

Illiashenko, Sergii, et al. “Opportunities, Threats and Risks of Implementation of the Innovative Business Management Technologies in the Post-Pandemic Period COVID-19.” WSEAS Transactions on Business and Economics, 2022.

Isabelle, D. A., Han, Y., & Westerlund, M. (2021, November 9). A Machine-Learning Analysis of the Impacts of the COVID-19 Pandemic on Small Business Owners and Implications for Canadian Government Policy Response.

Kalenkoski, Charlene Marie, and Sabrina Wulff Pabilonia. “Impacts of COVID-19 on the Self-Employed.” Small Business Economics, vol. 58, no. 2, Feb. 2022, pp. 741–68. Springer Link.

Kalogiannidis, S. (2020, December 21). Covid Impact on Small Business. International Journal of Social Science and Economics Invention.

Katare , B., Marshall, M. I., & Valdivia, C. B. (2021, July). Bend or break? small business survival and strategies during the COVID-19 shock.

Lucky, E. O.-I. (2012, March). The Misconception on Small Business Survival During Economic Downturn. Journal of Business Venture

Lofstrom, M., Bates, T., & Parker, S. C. (2023, May 19). Why are some people more likely to become small-business owners than others: Entrepreneurship entry and industry-specific barriers.

Lussier, R. N. (1995). A nonfinancial business success versus failure prediction mo. Journal of Small Business Management, 33(1), 8.

Martinez, Lisana B., Scherger, Valeria & Orazi, Sofía (2023) Post-pandemic performance of micro, small and medium-sized enterprises: A Self-organizing Maps application, Cogent Business & Management, 10:3.

McKoy, H. C. (2022). Race, Entrepreneurship, and COVID-19: Black Small-Business Survival in Prepandemic and Postpandemic America. In G. L. Wright, L. Hubbard, & W. A. Darity (Eds.), The Pandemic Divide: How COVID Increased Inequality in America (pp. 129–185). Duke University Press.

Meier, M., & Pinto, E. (2020, November). Covid-19 Supply Chain Disruptions.

Mishrif, A., & khan, A. (2023, August 30). Technology adoption as survival strategy for small and medium enterprises during COVID-19.

National Statistics. (n.d.). National Restaurant Association

Papanikolaou, D., & Schmidt, L. D. W. (2020). Working Remotely and the Supply-side Impact of COVID-19. Review of Corporate Finance Studies, 9(3), 564–579.

Parker, C., Bingley, S., & Burgess, S. (2023). The nature of small business digital responses during crises. Information and Organization, 33(4), 100487.

Rahimian, P. (2011, December). The Study of Barriers To Entrepreneurship in Men and Women. Australian Journal of Business and Management Research.

Rana, S. U. A. (2022). Entrepreneurs solve economic problems in Pandemic. Center for Open Science.

Rhaiem, K., & Halilem, N. (2023). The worst is not to fail, but to fail to learn from failure: A multi-method empirical validation of learning from innovation failure. Technological Forecasting and Social Change, 190, 122427.

Scarlat, E., & Delcea, C. (2011). Complete analysis of bankruptcy syndrome using grey systems theory. Grey systems: theory and application, 1(1), 19-32.

Scherger, V., Terceño, A., Vigier, H., & Gloria Barbera-Marine, M. (2015). Detection and Assessment of Causes in Business Diagnosis. Economic Computation & Economic Cybernetics Studies & Research, 49(4).

Theng, L. G., & Boon, J. L. W. (1996). An exploratory study of factors affecting the failure of local small and medium enterprises. Asia Pacific Journal of Management, 13, 47-61.

U.S. Department of Labor. (2020). Guidance on preparing workplaces for covid-19. https://www.osha.gov/sites/default/files/publications/OSHA3990.pdf

Weise, K. (2021, May 12). Amazon’s profit soars 220 percent as pandemic drives shopping online. The New York Times.

Wells, P. (2016, March). Economies of Scale Versus Small Is Beautiful: A Business Model Approach Based on Architecture, Principles, and Components in the Beer Industry. Sage Journals, 29(1).

Yip, G. S. (1982). Gateways to Entry. Harvard Business Review.

- Halabí, C. E., & Lussier, R. N. (2014) , Lussier, R. N. (1995) , Theng, L. G., & Boon, J. L. W. (1996),Eschker, E., Gold, G., & Lane, M. D. (2017) , Ghosh, B. C., Liang, T. W., Meng, T. T., & Chan, B. (2001), Scherger, V., Terceño, A., Vigier, H., & Gloria Barbera-Marine, M. (2015) ↵

- Halabí, C. E., & Lussier, R. N. (2014) , Lussier, R. N. (1995) , Theng, L. G., & Boon, J. L. W. (1996),Eschker, E., Gold, G., & Lane, M. D. (2017) , Ghosh, B. C., Liang, T. W., Meng, T. T., & Chan, B. (2001) , Scherger, V., Terceño, A., Vigier, H., & Gloria Barbera-Marine, M. (2015.) ↵